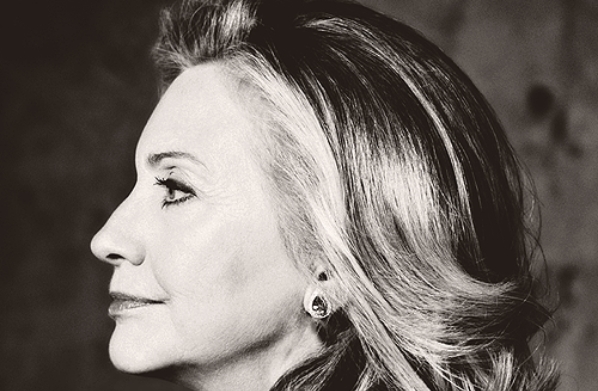

Under Hillary Clinton's economic plan, if you buy a stock and it gains in value quickly and you unload it for a profit, you'll have to pay frightfully high capital gains. I can imagine many people just getting out of the market altogether with strictures like this.

Of course, in addition to encouraging many Americans not to participate in the market, Clinton's plan would further distort the market. It would be expensive for people to act upon quick decisions about their portfolios. Andy Kessler, a hedge fund manager and author of "Eat People," explains Mrs. Clinton's policy in today's Wall Street comments:

Hillary Clinton’s big economic idea—ending corporate “short-termism,” as she calls it—will do more harm than good. On the campaign trail she rails against American corporations and the mysterious “tyranny of today’s earnings report.” Her solution is to raise capital-gains taxes and lengthen stockholding periods. Imagine anxiously waiting to unload during this month’s global selloff because of a holding period. Chalk it up as another misguided effort that will distort the information investors and companies rely on to make good decisions.

Markets run on signals. What could have been a housing downturn melted into the 2008 financial crisis in part due to lack of trading of mortgage derivatives in 2006-07. The prices didn’t reflect underlying value; it’s buying and selling of shares in the stock market that provides signals, to investors and to management, about the value of enterprises. Anything that mucks up those signals will be disastrous for decision making and the productive fabric of the economy.

Less trading means less information. Russia’s old stock exchange shut down amid the revolution in 1917 and eventually became a naval museum. Soviet planners embarked on five-year plan after five-year plan with no price signals. That experiment eventually failed. The Chinese are about to unveil their 13th Five-Year Plan. None of the previous plans highlighted Alibaba and the importance of online commerce. That’s because progress happens by surprise, not government planning. Investors need report cards to judge progress, and thus there’s quarterly disclosure.

Without market signals, managing a company becomes that much more iff. Knowing that you have to marry it rather than buy and sell it would make people less likely to get in the market, a great source of wealth for middle class Americans. Even on a day like today, when we're all reeling from what the market did yesterday, do we really want to make it more difficult for people to be in the market? What if you bought a stock, it did well, but you suddenly have fear for its future? Under Hillary's plan, you'd lose a lot of your profit if you made the decision to sell.

This economic policy is a clear indication that a Clinton II would not be anything like the prosperous Clinton I. Bill Clinton signed the Taxpayer Relief Act of 1997, which reduced capital gains by 20 percent and led to innovation in business and prosperity.

Mrs. Clinton's economic plan shows her more the inheritor of the mantle of President Obama.