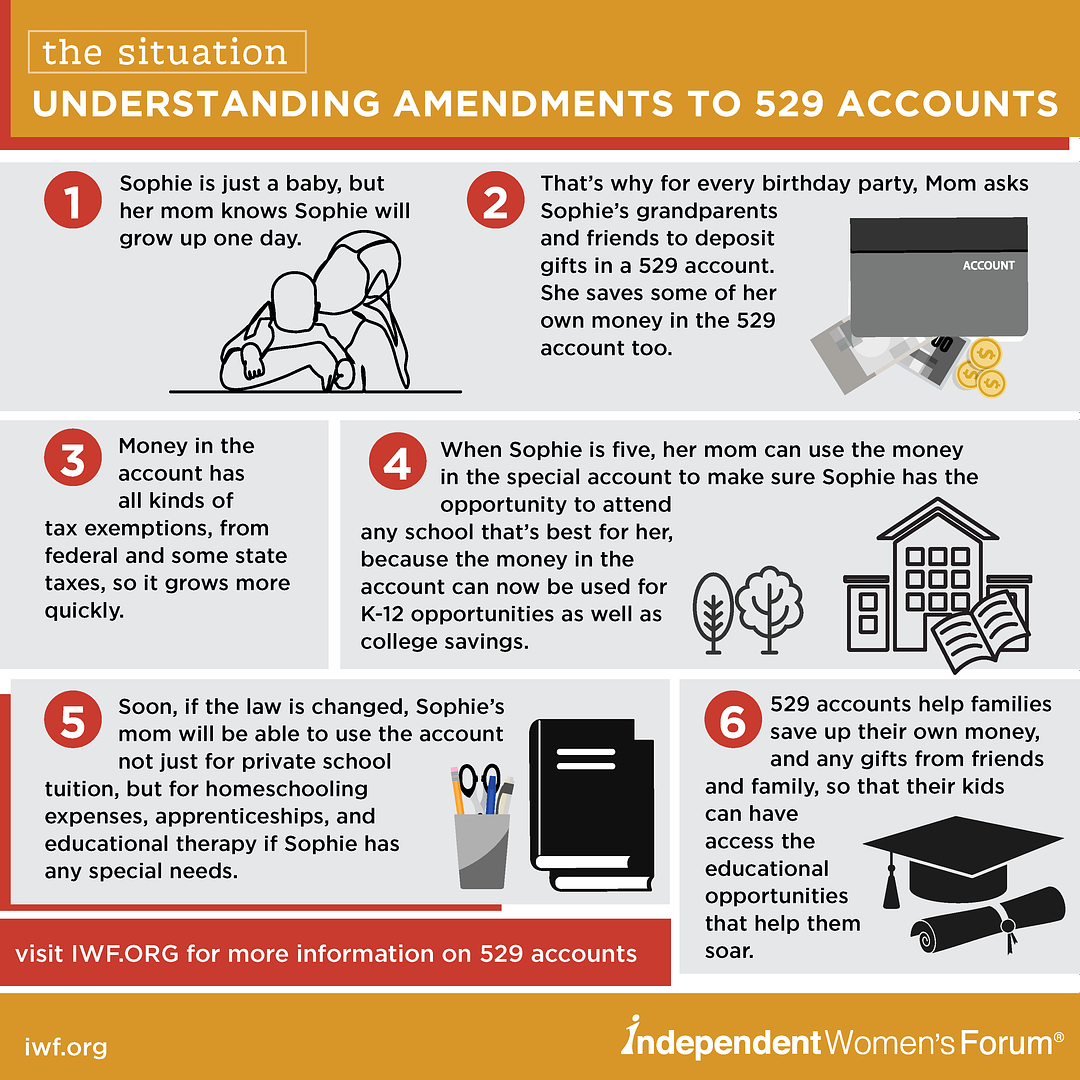

With the cost of college today, who can blame families for trying to save up a little extra in tax-preferred accounts? But those accounts – designated “529s” – are now about so much more than college expenses.

In 2017, 529s were expanded to encompass K-12 tuition costs. Anyone can contribute to a child’s 529, and an account for a child can be started any time after a woman learns she is pregnant. Grandparents, friends, and neighbors can all contribute to growing a nest egg that allows a young student-to-be to take advantage of whatever educational options are best for her, whether they be public or private.

Now, thanks to a bill in Congress, additional flexible uses may soon be added to the accounts’ possibilities. Building on the 2017 reforms, the new law would allow families to use their 529s to pay for home schooling expenses, apprenticeships and student loan expenses, and educational therapies for students with special needs, granting the flexibility and choice in education so many families desire.

Many parents today are unhappy with the education their children receive in their assigned traditional public schools. Maybe they’re concerned about low proficiency rates on standardized tests, or worried for their child’s safety at school. Parents across the country are also finding themselves locked in pitched battles with administrators about curriculum decisions, especially in contentious subject areas like American history or sexual education classes. By contrast, parent satisfaction with their children’s educational opportunities in programs that empower them to choose their child’s school remain universally high.

The interest made on investments in 529s accrues tax-free, which makes it easier for families – and other contributors to a child’s account – to save up meaningful amounts of their own money. Having the flexibility to apply that money to the best educational environment for their child, whatever that education looks like, is a boon for parents across the country.

Unfortunately, fewer than a third of parents know 529 accounts exist, and it’s likely an even smaller number know that the uses of 529s have been expanded beyond college savings. 529s won’t solve all families’ education problems, but they offer an important resource for families trying to save up to make sure their kids have access to the full range of educational options.

Spread the good word about 529s with your friends by using the graphic below!