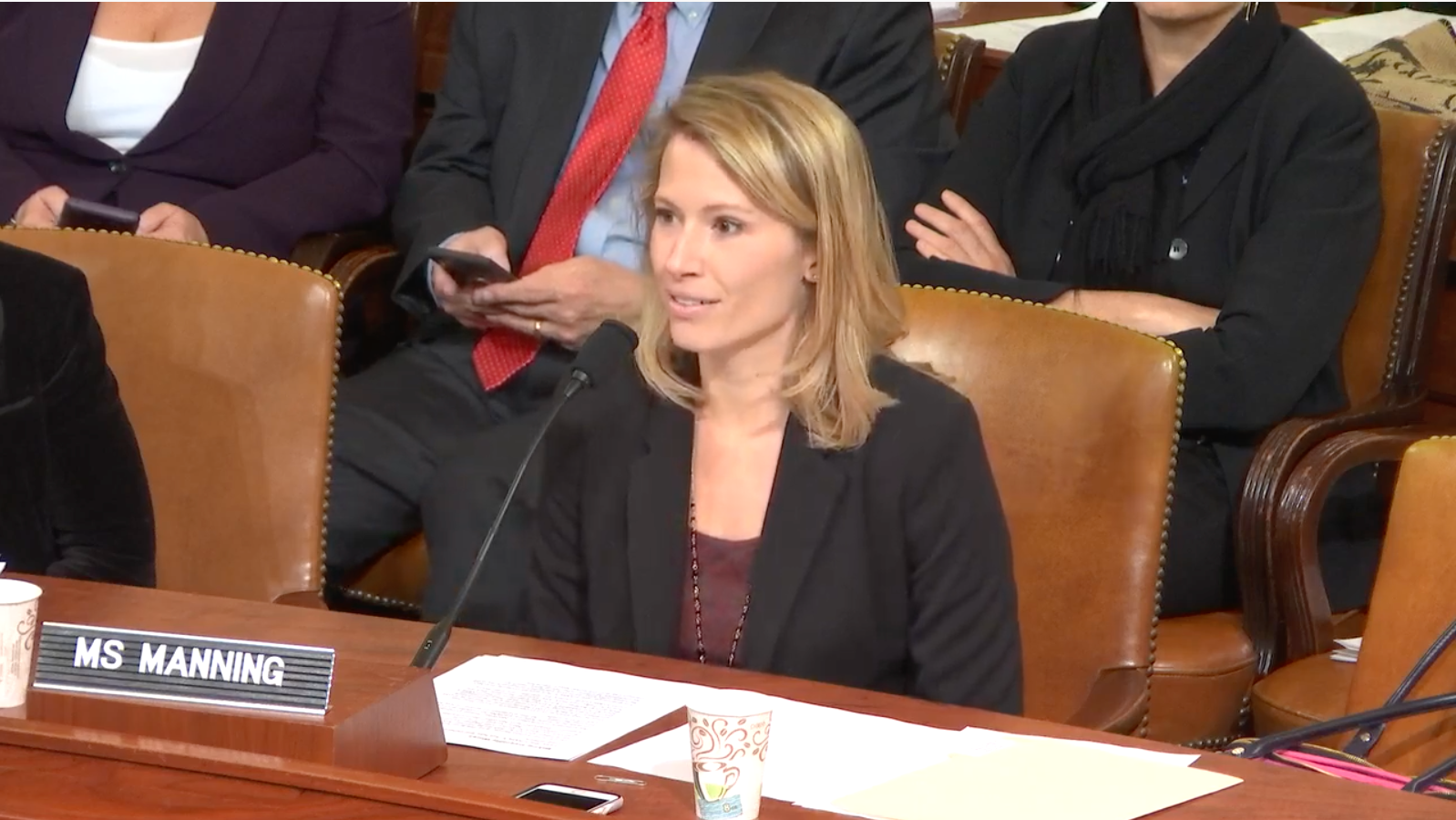

On Tuesday, Hadley Heath Manning, IWF’s Director of Policy, testified before the U.S. House of Representatives Committee on Ways and Means. She spoke about paid family and medical leave as the committee considered the FAMILY Act, which would impose a payroll tax on all workers to fund leave benefits for those who qualify. She says:

Lawmakers and the American people should be aware that such an approach, while well-intended, comes with serious policy tradeoffs, risk, and downsides. Namely, such a program could exacerbate inequalities, backfire on workers, and reduce overall economic opportunity.

She articulated how many studies, across the country and the world, have demonstrated that government paid family and medical leave programs distribute money from low-income workers to those with higher incomes. Then, Manning explained how the FAMILY act would backfire on workers, saying that it would

…reduc[e] the incentive for employers to provide paid family and medical leave benefits and increas[e] the incentive for workplace discrimination.

Finally, not only would the FAMILY Act take away flexibility and benefits for workers offered by employers, it would reduce their wages, as studies have shown that the burden of payroll taxes are carried by employees, with lower wages, instead of employers.

Manning finishes with:

Rather than instituting a universal, one-size-fits-all policy, lawmakers should focus any government intervention on helping those who need support most while otherwise allowing businesses and employees to continue to find their own personalized solutions that work best for them.

Read her testimony here or watch below.